South Africa braces for economic turmoil as US export tariffs take effect

US TARIFFS

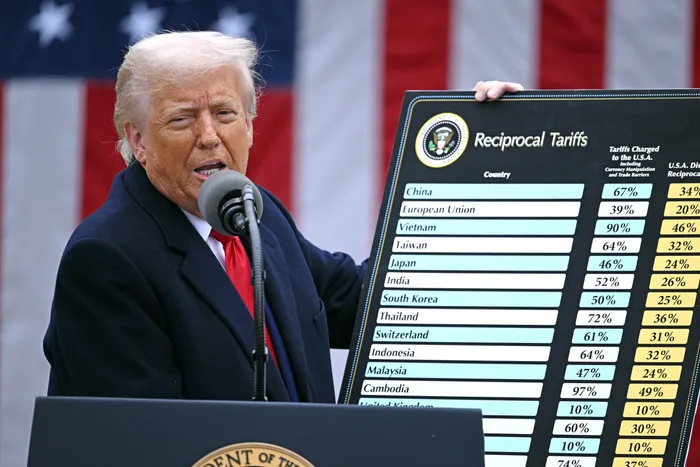

US President Donald Trump last month announced that his administration would levy a staggering 30% tariff on all South African products entering the US, with some exclusions or reduced tariffs on metals and minerals, in a bid to address long-standing trade imbalances and unfair market restrictions.

Image: Brendan Smialowski/AFP

August 1, 2025, marked the dawn of a new era for South Africa, albeit a troubling one, as a hefty 30% export tariff to the United States came into effect.

This significant policy change has sent ripples through the nation’s economy, stirring anxiety among businesses and consumers alike.

With no agreement in sight to prevent this trade burden, South Africans are bracing themselves for the ramifications on both local markets and international trade relations.

US President Donald Trump last month announced that his administration would levy a staggering 30% tariff on all South African products entering the US, with some exclusions or reduced tariffs on metals and minerals, in a bid to address long-standing trade imbalances and unfair market restrictions.

South Africa exports billions of rands’ worth of goods to the US each year, including fruit, vegetables, meat, and wine. These sectors employ thousands of workers, and the 30% tariff will render their products uncompetitive in the American market, placing immense pressure on producers and exporters.

Major South African exports to the US include precious stones and metals, motor vehicles, parts and accessories; iron and steel, machinery; aluminium products, ores, organic chemicals, chemical products, nickel products, agricultural products such as citrus fruits, wine, processed foods.

According to estimates, the tariffs will add roughly $3.5 billion (R63bn) to the cost of exports to the US, based on South Africa’s 2023 export value.

Thys van Zyl, CEO of Everest Wealth Advisory, on Thursday said South Africa was facing severe economic consequences without any formal agreement in place with its second-largest bilateral trading partner.

“It is almost unthinkable that, on the eve of such far-reaching tariffs, we still do not have a formal agreement – or even a timeline for when one can be expected. This is not only deeply concerning – it is negligent,” Van Zyl said.

Despite discussions between the relevant stakeholders, there are no confirmed exemptions, no concessions, and no sign of progress in negotiations with the US government.

The government has denied claims of a trade imbalance between South Africa and the US, maintaining that the 30% reciprocal tariff was not an accurate representation of available trade data.

Minister of Trade, Industry and Competition, Parks Tau, this week said they were working with other government departments on a response plan that also focuses on demand side interventions in the impacted industries.

Tau said the government was awaiting substantive feedback from the US counterparts on the final status on its Framework Deal, which proposed importing 75-100 petajoules of Liquified Natural Gas for a 10-year period, simplifying of US poultry exports under the 2016 tariff rate quota, and private sector commitments to invest $3.3bn in US industries such as mining and metals recycling.

However, Van Zyl said the lack of a formal agreement was sowing uncertainty for long-term business planning and investment beyond the immediate cost pressures.

“The only constant is uncertainty. Our export sectors are now left to fend for themselves – simply because the government acted too late and too vaguely,” said Van Zyl.

“Investors seek certainty – and what they’re now getting is ambiguity and silence. This is the kind of uncertainty that drives capital away. We need a proactive trade policy – one driven by results, not rhetoric. The government must take responsibility for this disastrous diplomatic outcome, and immediately table recovery plans to protect the export sector and restore investor confidence.”

Meanwhile, Foord Asset Management portfolio manager Farzana Bayat said a 30% tariff wall on South African exports to the US would be catastrophic and escalate trade risk.

“That would be a seismic shock. Even traditional US allies like the EU and Japan have negotiated reduced 15% tariffs - South Africa may not be so lucky,” Bayat said.

She said the stakes were high as the expiry of the African Growth and Opportunity Act in 2025 was already clouding the medium-term trade outlook.

Bayat said the immediate risk was acute as the South African Reserve Bank Governor Lesetja Kganyago recently warned that up to 100 000 jobs were at risk, and the automotive and citrus industries were especially exposed.

Car exports to the US have already collapsed by more than 80% due to earlier tariff pressures.

“This economic stress comes at a time when South Africa is already contending with low growth, power insecurity, and shaky investor confidence,” Bayat said.“Losing preferential access to the US - our third-largest trading partner - could be devastating.”

BUSINESS REPORT