The cost of living crisis: rent takes a bite out of youth income

An image showcasing a small-scale rental property.

Image: Supplied

Around 82% of young South Africans earn less than R6,000 per month, with a quarter of their income going toward rent or accommodation.

This is according to a new evidence-based study that examines how young people in SA think about money, what they earn and spend and how they manage to make ends meet.

“The ZAKA Index shows that young people aren’t careless with money and making impossible trade-offs in a high-cost environment,” says Leana de Beer, chief executive officer of WaFunda.

“The task now is to translate these insights into practical, continuous learning and targeted support that builds small buffers, improves decision-making and opens pathways to opportunity.”

Blackbullion South Africa, in partnership with Sanlam Foundation, announced the launch of the ZAKA Index on Friday last week.

The first edition of the Index surveyed people aged 18 to 35 nationwide, combining spending data with open responses to map the lived realities of youth finances.

The ZAKA Index is described as a recurring cost-of-living study designed to track financial pressures faced by young people, bringing to the fore the choices they make to navigate them.

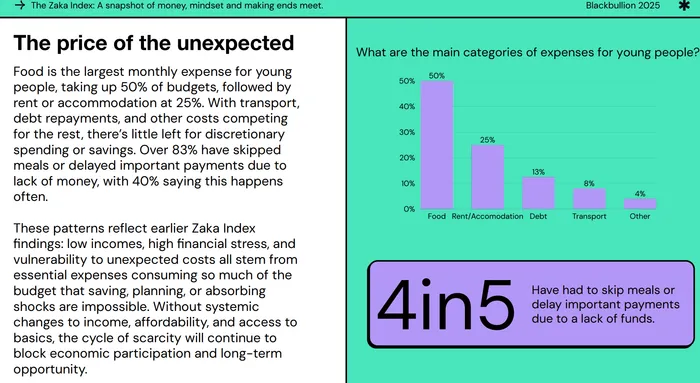

Blackbullion SA, a free financial education platform that equips young people with essential money skills and confidence through engaging, relevant learning experiences, said food is ranked as the single biggest monthly expense for 51% of participants.

The index shows that young people spend three quarters of their earnings on food and accommodation.

Image: Supplied

The resultant financial strain is pervasive: 51% report feeling financially stressed every day, and four in five say they have skipped meals or delayed important payments due to aThe cost of living crisis: rent takes a bite out of youth income lack of funds.

Similarly, transport runs as a parallel pressure point, adding to the bulk of monthly spend for most respondents.

Connectivity, particularly mobile data and airtime, is then identified as the top “luxury” purchase, and underlining that inclusion in education, work and social life increasingly depends on being online.

Beyond individual line items, the index paints a picture of fragile financial resilience.

Many respondents indicate that an unexpected R1,000 expense would force them to cut essentials, borrow from family and friends, or go without, highlighting how thin the margin is between coping and crisis.

“The data paints a dire picture, and the findings are unequivocal,” adds Tshepo Kgapane, product lead at WaFunda.

“Food and transport dominate budgets, and when costs spike, young people sacrifice essentials first, with a terrible knock-on effect across their monthly requirements. We’re using these findings to prioritise use-now tools, from budgeting journeys to micro-savings behaviours, that help stretch essentials and reduce month-end pressure," says Kgapane.

We see the value of evidence-led interventions,” notes De Beer.

“The index offers a clear baseline for how and where to support youth financial wellbeing, and it will inform our collaboration to improve access to relevant financial education and resources.”

While a minority report occasional discretionary purchases (such as takeaways), most participants say they rarely or never spend on typical “luxuries” and that entertainment subscriptions are often non-existent or shared.

The data also suggests a gap between income and needs: a substantial share of young people say their current earnings do not match everyday costs, making long-term planning difficult and entrenching month-to-month survival strategies.

The Index uses an online national survey distributed through social media, email and partner networks.

It captures quantitative (income, spending, budgeting) and qualitative (attitudes, emotions, open responses) data.

The 2025 cohort includes Blackbullion users and non-users, offering a broad cross-section of youth experiences across provinces and life stages (students, job seekers and young workers).

The authors of the ZAKA Index indicate that financial literacy must be paired with financial leeway.

They note that knowledge helps, but when most young people live below a sustainable income threshold, small shocks can derail progress.

At the same time, the findings highlight clear leverage points, including targeted budgeting support, affordable connectivity, and solutions that reduce transport frictions.

This can improve day-to-day stability while young people pursue work and study opportunities, they note.

Over the next year, Blackbullion and partners said that they will follow the same cohort, using the index to track shifts in behaviour as interventions roll out.

According to the first Cost of Living (COL) report released by the Competition Commission - which includes items beyond essential food to provide a more inclusive and representative view of household economic realities - the cost of rent for houses and flats in SA increased moderately over the period and has remained below overall inflation over the past five years.

However, electricity prices increased by 68% and water prices went up by 50% which is a much higher rate than general inflation, which increased by 28%.

Independent Media Property

Related Topics: